Welcome to PF 2011 accounting software presentation tutorial number 14. In this tutorial we will guide you step by step on how to prepare your W2 and W3 forms. First, open PF 2011 and select a client from the menu ribbon. Next, click at the payroll tab and select government forms from the drop-down menu. This section of the program requires the annual payroll subscription. You can create new W2 entries by clicking new W2 entry and by completing all the entries manually. For individual employees, you can transfer all wages from the payroll registry by clicking at the button transfer wages to W2. If you have any additional employees that are not in the payroll registry, you can enter them after the transfer. Please do not enter individual entries before the transfer. Otherwise, all your data will be erased. Click at the button w2 slash w3 totals to view a summary of all the employees wages and withholding. Now, let's print the W2 forms. Click at the prints W2 button and select to print all the copies. If you have a laser printer, and you have purchased the red or SSA blank copy, make sure you align it by selecting a line blank SSA and then select copy a blank. If you file electronically, select copy a full send it to the printer and keep it for your records. Do not send a laser black and white copy to the SSA. Click at the button edit W3 and click at the button new W3 to create the W3 form. Then, click Save. If you have a blank red laser SSA form before you print, make sure you align it with your printer by selecting align blank W3.

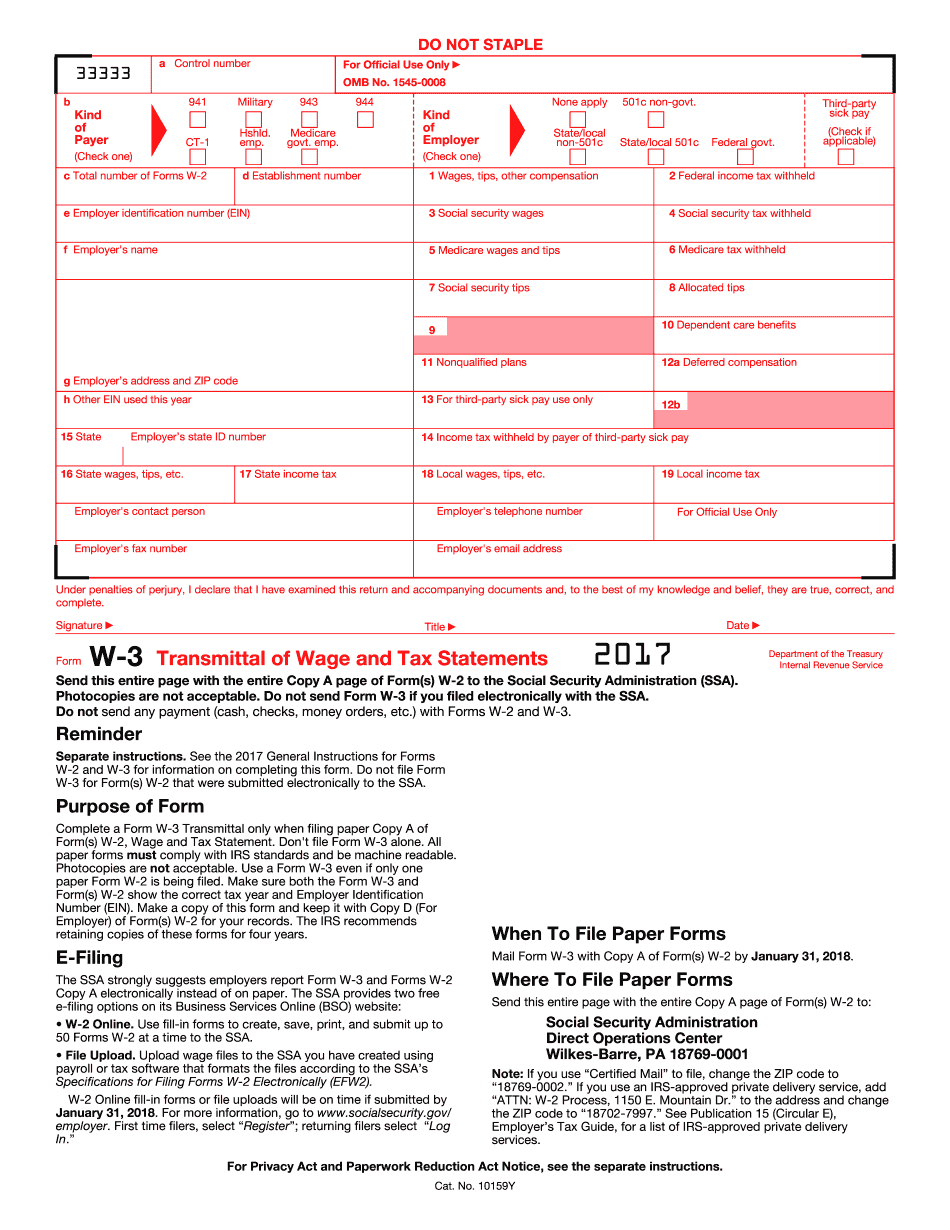

What you should know about W 3 Form 2017

- Do not file Form W-3 for electronically submitted W-2s

- Employers are strongly suggested to electronically report Form W-3 and Forms W-2 Copy A

- Photocopies of Form W-2 are not acceptable

Award-winning PDF software

How to prepare W 3 Form 2017

1

Open up the template

You do not have to find a template of 2024 IRS W-3 on the web and download the file. Open up the form immediately inside the editor with a single click.

2

Complete the form

Complete each field within the template providing legitimate details. If you have a signature field, you can include your eSignature to create the document lawfully valid.

3

File on the internet

You are able to download the form or deliver it online by e mail, fax, or Text message. Use Send via USPS attribute to deliver an actual document without leaving your house.

About 2024 IRS W-3

The IRS W-3 form is a transmittal form for employers to submit their employees' W-2 forms. It is used to summarize and transmit W-2 information to the Social Security Administration (SSA). The W-3 form includes total wages, taxes withheld, and other relevant information about the employees. Employers, including businesses, organizations, and government agencies, who have employees with income subject to Medicare, Social Security, or Federal income tax withholding, are required to file a W-3 form. Additionally, any employer who is filing W-2 forms electronically is also required to submit a W-3 form to the SSA. In summary, any entity that has employees and issues W-2 forms must file a W-3 form with the appropriate tax authorities.

How to complete a W 3 Form 2017

- Make sure you are completing the form for filing paper Copy A of Form W2 Wage and Tax Statement.

- Do not file Form W3 for electronically submitted Form W2s to the SSA.

- Provide accurate information including tax year and EIN on both Form W3 and Form W

- Sign and date the Form W3 when required.

- Mail Form W3 with Copy A of Form W2 by January 31, 2018, if filing on paper.

- Do not staple any documents to the form.

- Keep a copy of the filled out form for your records for at least four years.

- Visit www.irs.gov/w2 for more information on filing requirements and penalties.

People also ask about W 3 Form 2017

What is Form W-3 used for?

Form W-3 is used to transmit paper Copy A of Form s W-2 to the SSA.

Can Form W-3 be filed if W-2s were submitted electronically?

No, Form W-3 should not be filed if W-2s were submitted electronically to the SSA.

When should Form W-3 be filed?

Form W-3 should be mailed with Copy A of Form s W-2 by January 31, 2018.

What people say about us

Gain access to professional filing capabilities

Video instructions and help with filling out and completing W 3 Form 2024